Global economic trends shape the landscape of investments. Investors need to stay informed about these trends to make strategic decisions. Understanding these dynamics can lead to business expansion and successful franchising.

This article delves into how global economic trends impact investments.

Economic Growth and Investments

Economic growth drives investments. When economies expand, businesses thrive. This growth creates opportunities for investors. Companies often seek funding to capitalize on new markets. Business expansion becomes a key focus. Investors look for sectors with high growth potential. Franchising has become a popular model in booming economies.

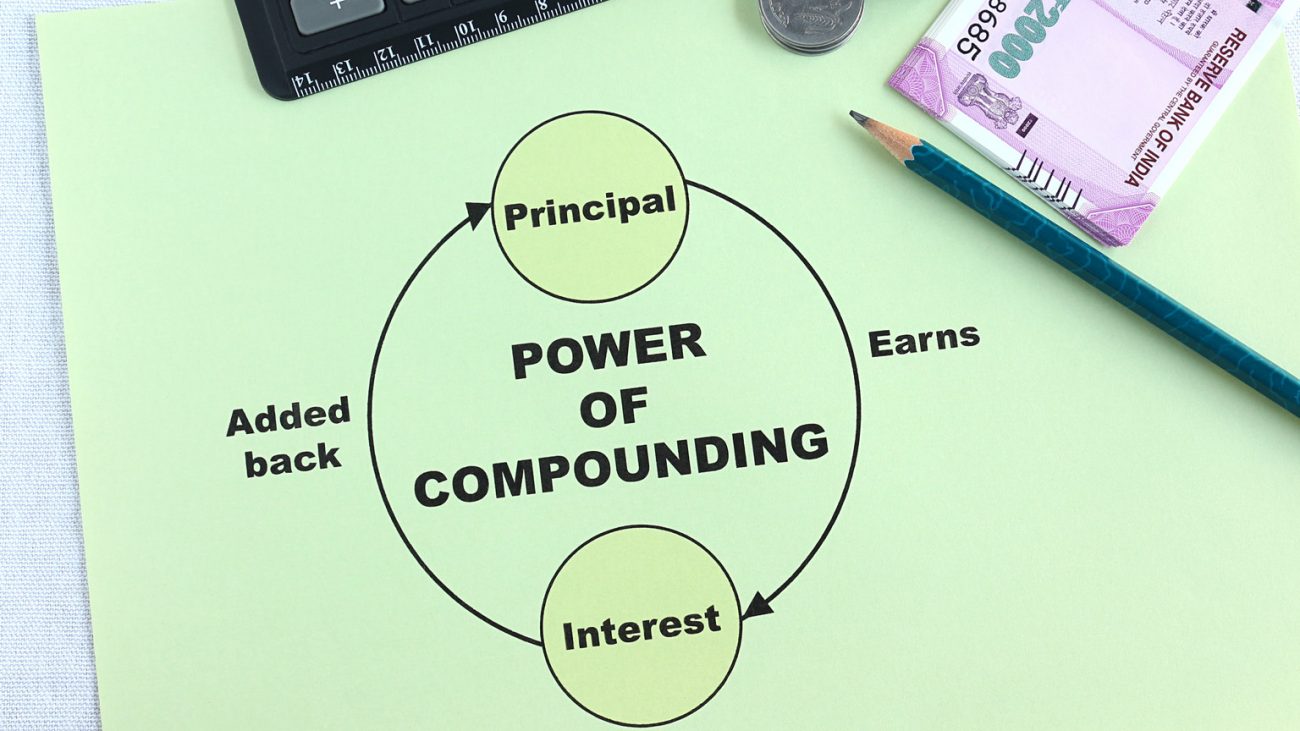

Interest Rates and Investment Decisions

Interest rates significantly influence investment choices. Low-interest rates make borrowing cheaper. This environment encourages businesses to invest. High-interest rates, conversely, increase borrowing costs. Investors may shift focus to bonds and other fixed-income securities. Monitoring central banks’ policies helps investors anticipate rate changes.

Inflation and Asset Allocation

Inflation affects the purchasing power of money. High inflation can erode investment returns. Investors often seek assets that outpace inflation. Real estate and commodities are common choices. Diversification helps mitigate inflation risks. Understanding inflation trends is crucial for maintaining portfolio value.

Technological Advancements and Market Dynamics

Technological advancements reshape industries. New technologies can disrupt traditional business models. Investors must identify emerging tech trends. Companies embracing innovation often attract investment. Business expansion in tech-driven sectors offers high returns. Franchising tech solutions can lead to rapid growth.

Geopolitical Stability and Investment Risks

Geopolitical stability impacts investment risks. Political unrest can lead to market volatility. Investors prefer stable regions with predictable policies. Understanding geopolitical trends helps in risk assessment. Diversifying investments across regions mitigates these risks.

Trade Policies and Global Investments

Trade policies influence global investment flows. Tariffs and trade agreements affect market access. Favorable trade policies boost investor confidence. Businesses expand operations in regions with open trade. Franchising becomes easier in such environments. Monitoring trade developments is essential for strategic investments.

Exchange Rates and International Investments

Exchange rates affect the value of international investments. Currency fluctuations impact returns. Investors must consider exchange rate risks. Hedging strategies can protect against adverse movements. Businesses expanding internationally face these challenges. Understanding currency trends is vital for global investments.

Environmental, Social, and Governance (ESG) Factors

ESG factors are increasingly important for investors. Companies with strong ESG practices attract more investment. Sustainable business models are gaining traction. Investors prioritize firms with ethical practices. ESG considerations influence long-term investment decisions. Monitoring ESG trends is essential for responsible investing.

Demographic Trends and Market Opportunities

Demographic trends create new market opportunities. Aging populations, for example, drive demand for healthcare. Young populations may increase demand for tech products. Investors analyze demographic data to identify growth areas. Business expansion strategies often target these trends. Franchising in demographic hotspots can be highly profitable.

Financial Markets and Investment Strategies

Financial markets reflect broader economic trends. Market performance influences investor sentiment. Bull markets encourage risk-taking. Bear markets lead to cautious strategies. Understanding market cycles is crucial for investment planning. Diversified portfolios help navigate market volatility.

Impact of Global Pandemics

Global pandemics, like COVID-19, have profound economic impacts. They disrupt supply chains and consumer behavior. Investors must adapt to such crises. Business expansion may slow during pandemics. Franchising models need flexibility to withstand such shocks. Pandemic preparedness is now a key investment consideration.

Regulatory Changes and Compliance

Regulatory changes impact business operations. New regulations can create opportunities or pose challenges. Investors monitor regulatory environments closely. Compliance costs must be factored into investment decisions. Understanding regulatory trends helps in strategic planning. Business expansion in regulated sectors requires careful navigation.

Globalization and Investment Diversification

Globalization has increased investment opportunities. Investors can now access markets worldwide. Diversifying investments across regions reduces risks. Business expansion strategies often include global markets. Franchising international brands can lead to significant growth. Understanding globalization trends is essential for modern investors.

Conclusion

Global economic trends shape the investment landscape. Staying informed about these trends is crucial for success. Investors must adapt to changing economic conditions. Business expansion and franchising offer growth opportunities. Strategic investments require understanding global dynamics.

For personalized investment strategies and expert guidance, contact FIM Investment.

Our team is dedicated to helping you direct global economic trends and optimize your investment portfolio.

Reach out to us today to start planning your financial future.