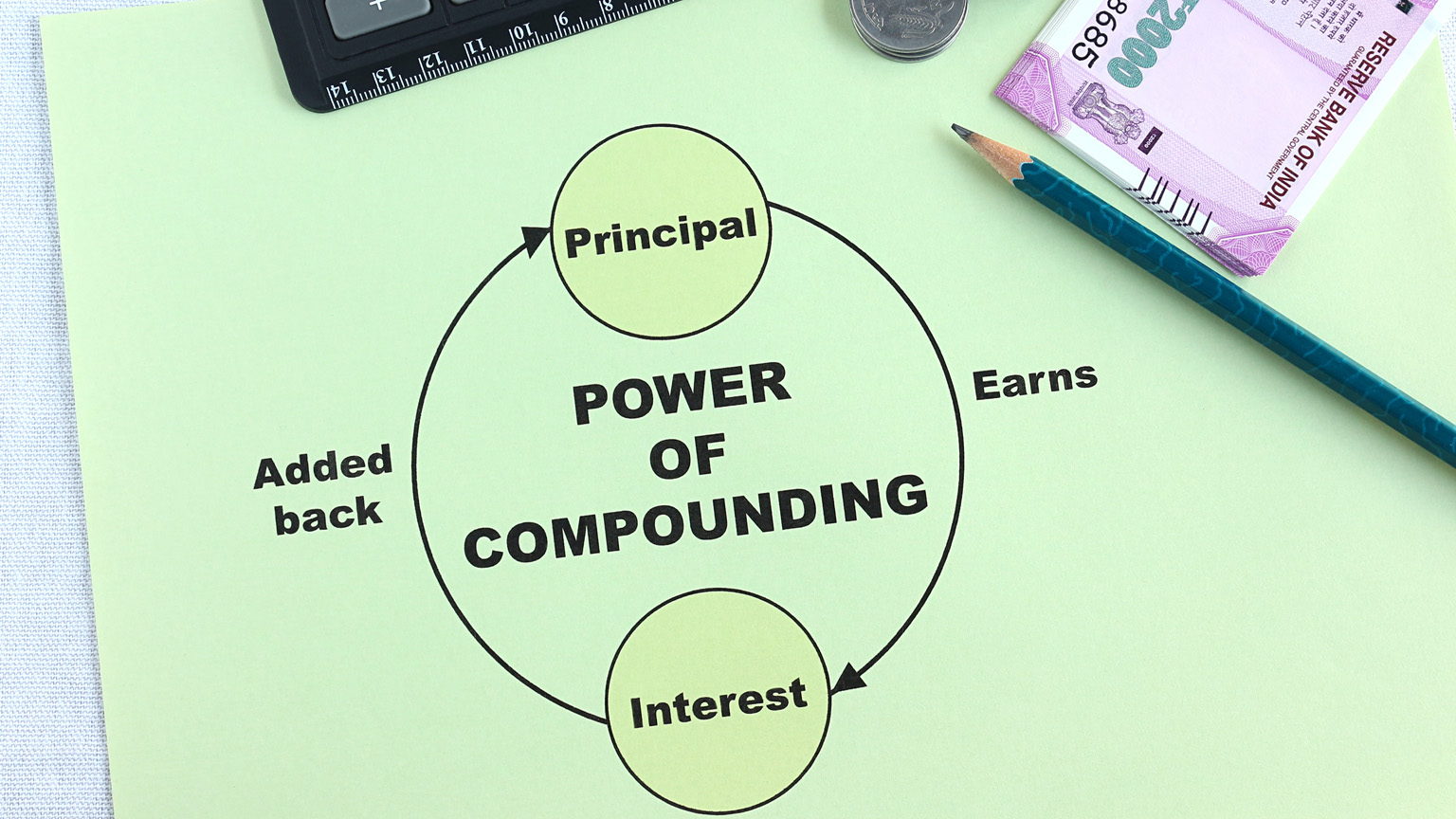

Compound interest is a powerful tool in wealth building. It involves earning interest on both the initial principal and the accumulated interest from previous periods. This financial concept can significantly grow your investments over time.

Understanding compound interest is crucial for anyone looking to build wealth. It is a fundamental principle that underpins many successful investment strategies.

Let’s delve deeper into how compound interest works and its benefits.

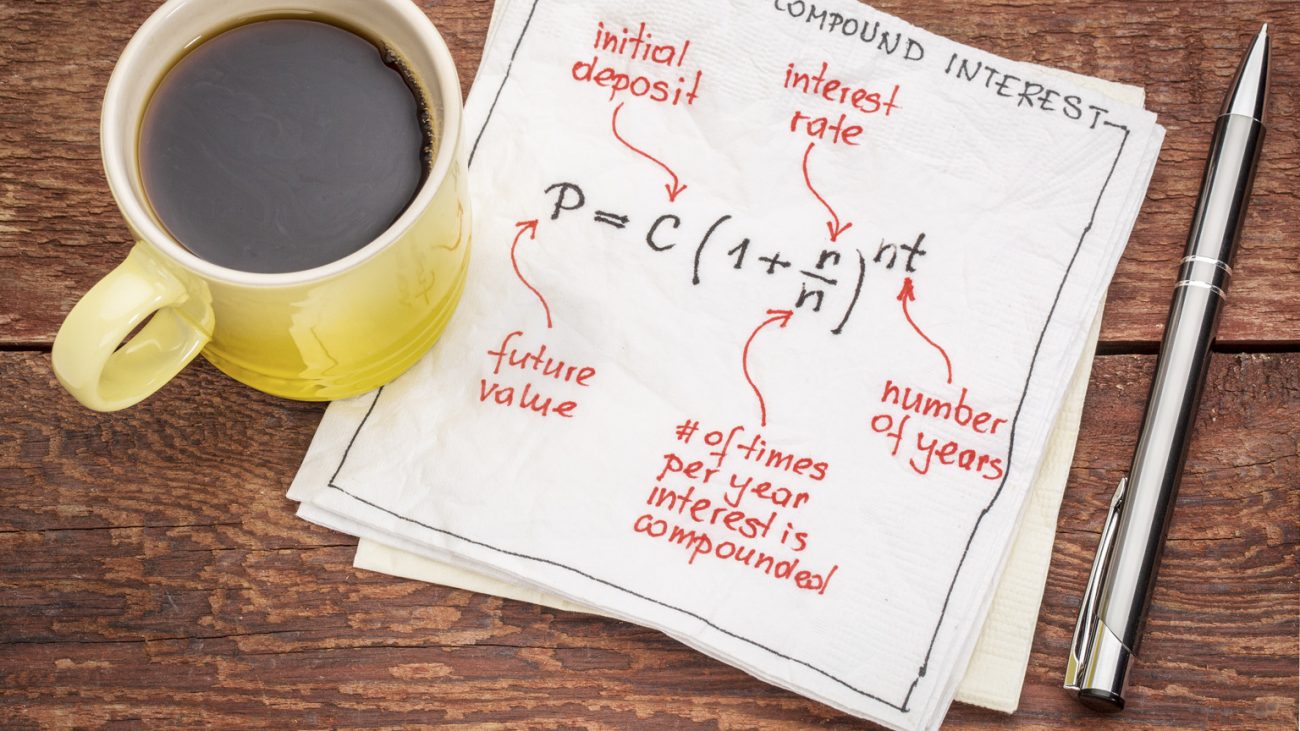

How Compound Interest Works

Compound interest works on the principle of earning interest on interest. For example, if you invest $1,000 at an annual interest rate of 5%, you will earn $50 in interest after the first year. In the second year, you will earn interest on the new total of $1,050, resulting in $52.50. This cycle continues, with your investment growing at an accelerating rate.

Regular contributions to your investment can further enhance the effects of compound interest. Consistently adding funds allows you to benefit from the compounding effect on a larger principal amount. This approach is especially effective in long-term investment plans.

The Time Factor

Time plays a crucial role in the power of compound interest. The longer your money remains invested, the more you will benefit from compounding. Starting early is key. Even small investments can grow substantially over several decades.

Young investors have a significant advantage due to the extended period for compounding. For instance, investing $1,000 annually at an 8% return starting at age 25 will result in more wealth at retirement compared to starting the same investment at age 35. The difference is due to the additional years of compounding.

The Importance of Interest Rate

The interest rate directly affects the growth of your investments through compound interest. Higher interest rates lead to more substantial returns. It is important to seek investment opportunities with competitive interest rates to maximize your wealth-building potential.

Comparing different investment options based on their interest rates is essential. Even a small difference in interest rates can have a significant impact over time. For example, an investment growing at 6% annually will yield more over 30 years than one growing at 5%.

Practical Applications

Compound interest is widely used in various financial instruments. Savings accounts, bonds, and mutual funds are common examples. These investment vehicles offer opportunities to earn compounded returns, aiding in wealth accumulation.

Savings accounts typically offer lower interest rates but provide a safe and liquid option for compounding. Bonds and mutual funds, on the other hand, may offer higher returns with varying degrees of risk. Diversifying investments across different assets can optimize returns while managing risk.

Strategies for Maximizing Compound Interest

To maximize the benefits of compound interest, consider these strategies:

- Start Early: Begin investing as soon as possible to leverage the time factor. Even modest investments can grow significantly over the long term.

- Make Regular Contributions: Consistently add to your investments to increase the principal amount, which in turn increases the compounding effect.

- Reinvest Earnings: Reinvest dividends and interest earnings to take full advantage of compounding.

- Choose Higher Interest Rates: Opt for investment options with competitive interest rates to maximize growth.

- Diversify Investments: Spread your investments across different asset classes to manage risk and optimize returns.

The Impact on Retirement Planning

Compound interest is particularly beneficial for retirement planning. Investing in retirement accounts such as 401(k)s or IRAs allows you to accumulate significant wealth over time. These accounts often offer tax advantages, further enhancing the compounding effect.

Regular contributions to retirement accounts, combined with the power of compound interest, can provide a substantial nest egg for your golden years. It is essential to start contributing early and take advantage of employer matching programs where available.

Examples

Consider the example of two investors, Alice and Bob. Alice starts investing $200 a month at age 25, while Bob starts the same investment at age 35. Assuming an annual return of 7%, Alice’s investment will grow to approximately $486,000 by age 65. In contrast, Bob’s investment will grow to around $228,000. The ten-year head start gives Alice a significant advantage due to compound interest.

Overcoming Challenges

While compound interest is powerful, it is essential to remain disciplined. Avoid the temptation to withdraw earnings prematurely. Market fluctuations and economic downturns can impact short-term returns, but maintaining a long-term perspective is crucial.

Patience and consistency are key. Regularly review and adjust your investment strategy to ensure it fits with your financial goals. Seeking advice from financial professionals can provide valuable insights and help optimize your investment plan.

Conclusion

Compound interest is a cornerstone of wealth building. Understanding its principles and implementing effective strategies can lead to substantial financial growth. Start investing early, make regular contributions, and choose investments with competitive interest rates to harness the full power of compound interest.

At FIM, we specialize in business expansion, franchise business, and investor funding in Dubai. Leverage our expertise to grow your wealth efficiently. Take control of your financial future today.

Start leveraging the power of compound interest and watch your wealth grow. For personalized investment strategies and expert advice, contact our financial advisors.

Invest in your future now!