Venturing into investor funding is both an exciting and challenging endeavor. It’s about envisioning and actively shaping the future. Aspiring investors need a clear vision and a robust strategy to understand this dynamic landscape effectively.

This comprehensive guide will walk you through the essential steps and considerations to become a successful venture investor, focusing on investor funding and investor funding in Dubai.

Understanding the Basics of Venture Investing

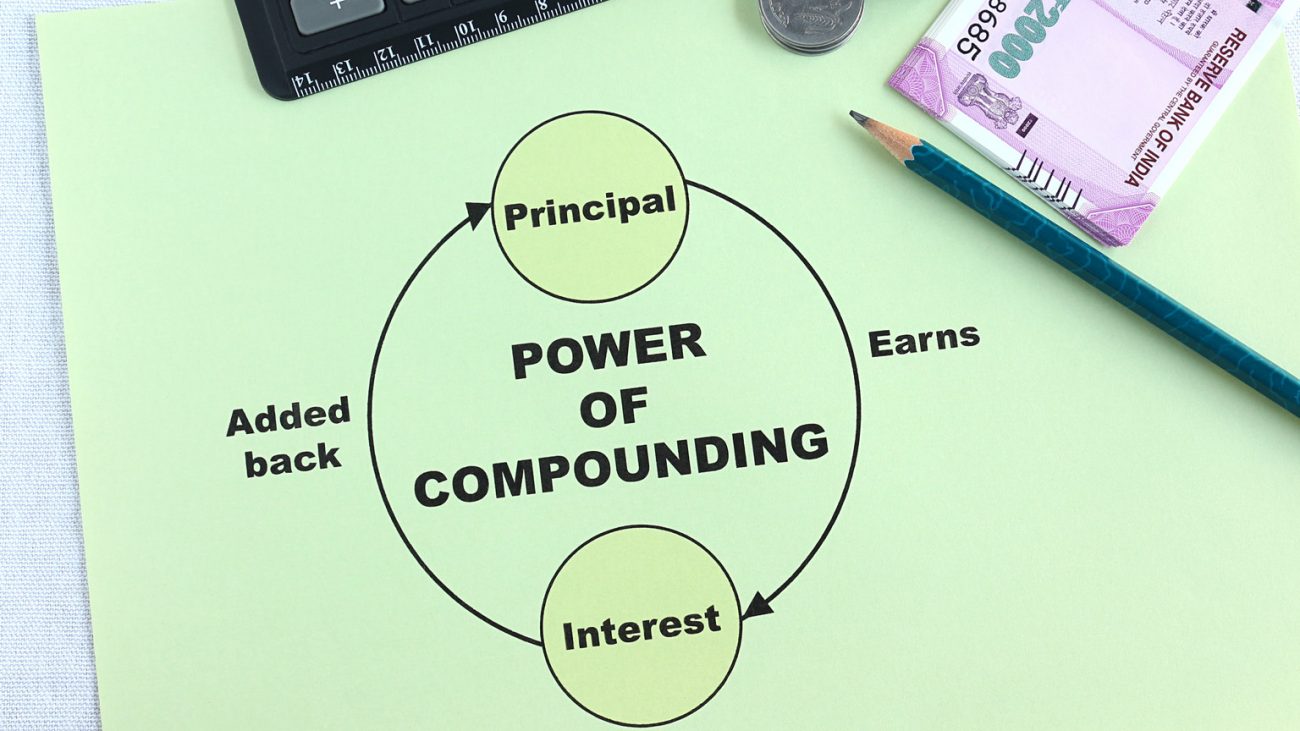

Venture investing involves funding startups and early-stage companies with high growth potential. Unlike traditional investments, venture capital is about taking calculated risks on innovative ideas and passionate entrepreneurs. The goal is to achieve substantial returns when these companies succeed.

Research for The Foundation of Successful Investing

Research is the cornerstone of successful venture investing. Start by understanding the market and its trends. This includes keeping abreast of the latest developments in technology, consumer behavior, and industry innovations. Subscribing to industry publications, attending seminars, and joining online forums can provide valuable insights into emerging trends and opportunities.

Building a Network of Experienced Investors

Connecting with experienced investors can provide invaluable insights and mentorship. Networking events, industry conferences, and online forums are excellent platforms for meeting seasoned investors. Engaging in conversations with them can help you understand the intricacies of venture investing, from deal sourcing to exit strategies.

Analyzing Potential Investments

Careful analysis of potential investments is crucial. This involves evaluating the startup’s team, product, and market potential. Look for founders with a proven track record, a clear vision, and the ability to execute their plans. The product should address a real need or problem in the market, and the market itself should have significant growth potential.

Diversification for Spreading Your Risk

Diversification is a key strategy in managing investment risk. By spreading your investments across different sectors and industries, you mitigate the impact of any single investment’s failure. This approach balances your portfolio and also increases your chances of hitting a high-return investment.

Staying Updated with Industry Trends

The venture investing landscape is continually evolving. Staying updated with industry news and trends is essential for making informed investment decisions. Follow industry leaders, join relevant groups on social media, and participate in discussions to stay ahead of the curve. Continuous learning and adaptation are crucial in this fast-paced environment.

Patience and Long-Term Vision

Venture investing requires patience. Unlike traditional investments, returns from venture capital often take years to materialize. It’s essential to have a long-term vision and not be discouraged by short-term fluctuations. Successful investors understand that building a high-growth company takes time and perseverance.

Consistent Portfolio Evaluation

Regular evaluation of your investment portfolio is necessary to ensure it matches with your goals. Assess the performance of each investment and make adjustments as needed. This could involve increasing your stake in high-performing companies or divesting from those that are underperforming. Keeping a close eye on your portfolio helps in making strategic decisions.

Joining Investment Groups

Joining an investment group can be highly beneficial, especially for new investors. These groups provide support, shared resources, and access to a broader network. Investment groups often have a collective pool of knowledge and experience, which can help in making better investment decisions. They also offer opportunities to participate in larger deals that might be beyond the reach of individual investors.

Passion and Belief in Your Investments

Being passionate about your investments can drive success. When you believe in the potential of the companies you invest in, it shows in your commitment and support. Passionate investors often go beyond financial support, offering guidance, mentorship, and connections to help startups succeed. This hands-on approach can significantly impact the growth and success of your investments.

Understanding Legal and Regulatory Aspects

Understanding the legal and regulatory aspects of venture investing is crucial. This includes knowledge of securities laws, investor rights, and compliance requirements. Engaging with legal experts can help navigate these complexities and ensure that your investments are secure and compliant with relevant regulations.

Developing a Robust Exit Strategy

An exit strategy outlines how you plan to realize returns from your investments. This could involve selling your stake through an initial public offering (IPO), acquisition by another company, or secondary sales. A well-thought-out exit strategy helps in maximizing returns and planning for future investments.

Leveraging Technology and Analytics

In today’s digital age, leveraging technology and analytics can give you a competitive edge. Use data analytics tools to assess market trends, evaluate startups, and track the performance of your investments. Technology can also help in automating processes, managing your portfolio, and staying updated with industry developments.

Building Strong Relationships with Founders

Building strong relationships with the founders of the companies you invest in is essential. Open communication, mutual respect, and trust form the foundation of these relationships. Regular interactions with founders help in understanding their challenges, providing timely support, and ensuring that the company stays on track to achieve its goals.

The Importance of Due Diligence

Due diligence is a critical step in the investment process. It involves a thorough examination of the startup’s business model, financials, market position, and potential risks. Conducting comprehensive due diligence helps in identifying potential red flags and making informed investment decisions. It also ensures that you are investing in startups with a solid foundation and high growth potential.

Embracing a Growth Mindset

Successful venture investors embrace a growth mindset. They are always learning, adapting, and evolving. This mindset helps in navigating the uncertainties of venture investing and staying resilient in the face of challenges. Being open to new ideas, learning from failures, and continuously improving your investment strategy are key to long-term success.

Supporting the Startup Ecosystem

Venture investors play a crucial role in supporting the startup ecosystem. Beyond providing capital, they contribute to the growth of the ecosystem by sharing knowledge, offering mentorship, and creating opportunities for collaboration. Active involvement in the ecosystem not only benefits startups but also enhances your reputation and network as an investor.

Ethical Investing and Social Impact

Ethical investing and considering the social impact of your investments are becoming increasingly important. Many investors are now focusing on startups that meet with their values and contribute positively to society. Investing in socially responsible startups not only drives positive change but can also lead to sustainable and profitable returns.

Investor Funding in Dubai

Dubai has emerged as a significant hub for investor funding, attracting venture capitalists from around the world. The city’s strategic location, robust infrastructure, and business-friendly policies make it an ideal place for venture investing. Investor funding in Dubai offers unique opportunities in various sectors, including technology, real estate, and healthcare. The government’s initiatives to foster innovation and entrepreneurship further enhance the city’s appeal to investors.

Conclusion

Becoming a successful venture investor is a journey that requires dedication, knowledge, and strategic thinking. It’s about believing in the potential of innovative ideas and passionate entrepreneurs. With the right approach, you can make a significant impact on the future while achieving substantial returns.

This guide provides a roadmap for aspiring venture investors. By understanding the market, building a network, analyzing investments, diversifying, and staying informed, you can understand the complexities of venture investing. Patience, passion, and a growth mindset will drive your success. Remember, venture investing is a dynamic and evolving field, and continuous learning and adaptation are essential.

Investor Funding and Key Takeaways

Investor funding is a critical component of venture investing. It involves providing the necessary capital to startups and early-stage companies, enabling them to develop and scale their businesses. Whether you’re focusing on investor funding in Dubai or other global markets, the principles remain the same and FIM is here to help you with your company or project.

Thorough research, careful analysis, and strategic decision-making are essential for successful investments.

Dubai’s burgeoning startup ecosystem and supportive regulatory environment offer unique opportunities for venture capitalists. By leveraging these advantages, you can tap into a market with high growth potential and diverse investment opportunities.

Contact us for a venture investor, keep these key takeaways in mind to guide your decisions and maximize your success!